A Dive Into Therapeutics for Reproductive Health

We need to change our definition of the reproductive health system

Table of Contents

Introduction

Recently in venture capital, there’s been a focus on technology that can improve women’s health - known as FemTech (Female Technology). Notably, there has been an increase in virtual clinics or at-home diagnostics for many reproductive conditions1. It’s a groundbreaking movement shifting awareness and funding to an overlooked field.

While these companies help diagnose more women, it’s just the start of bringing women’s health to focus. In parallel, we also need to push for new therapeutics for women, especially in female reproductive conditions.

The biotech industry has experienced an explosion of new therapeutic modalities like antisense oligonucleotides (ASOs), small-interfering RNA (siRNAs), and antibody-directed conjugates (ADCs) being used to treat patients. In the last decade, we’ve seen the success of CAR-T therapies and mRNA vaccines pioneered by biotech companies. We’ve shifted from being 50% effective to nearly 95% effective in the treatment of certain cancers.

With the founder-led bio movement pushing for more scientific breakthroughs to turn into companies, there’s never been a better time for innovating new therapeutics for reproductive health. The right combination of groundbreaking scientific advancements and the growing momentum of FemTech is helping pave the way for the next generation of repro-focused biotech companies.

Brief Primer on the Female Reproductive System

Reproductive health is often equated to infertility issues, which fail to encompass its broader functions in a person’s lifespan. The reproductive system can be seen through a lifespan framework. This framework shows how different conditions, disorders, and needs can arise throughout life.

There are two major classes of disorders: malignant (cancerous) & benign disorders. Many cancers affecting the reproductive health system, such as cervical and ovarian, are still some of the leading causes of death among people of reproductive age2. The impact of benign disorders such as endometriosis, placental, and embryo implantation disorders, although non-life threatening, severely impacts a person’s ability to work, quality of life, and can become chronic disorders that require lifelong management.

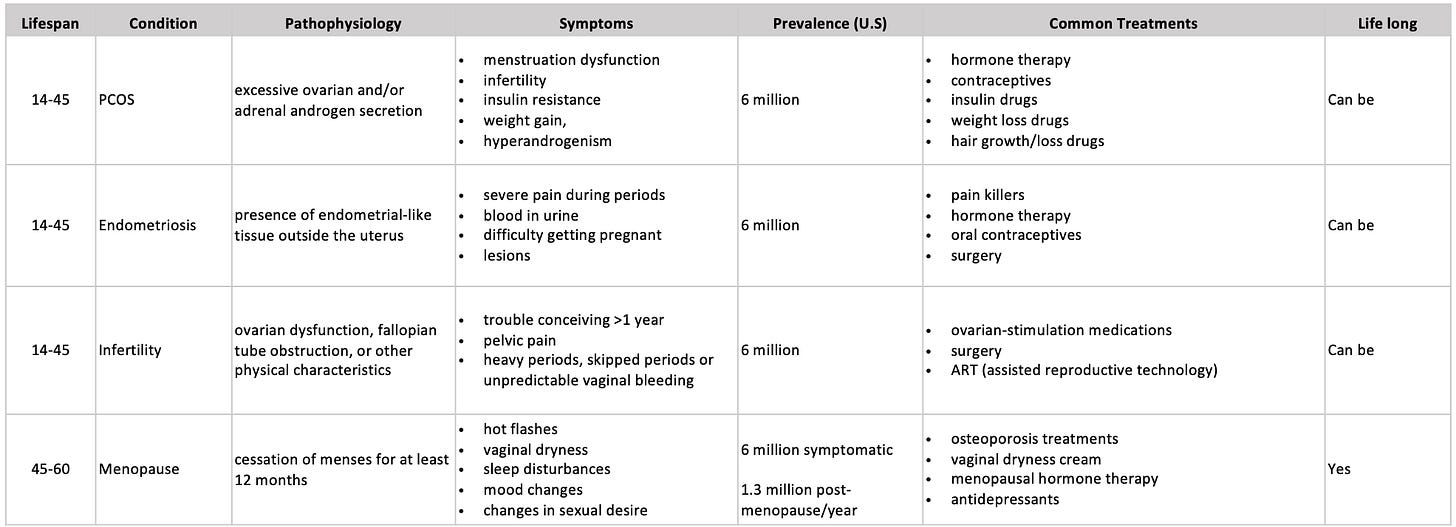

The most common conditions are benign, with polycystic ovary syndrome (PCOS), endometriosis, infertility, and menopause, with each disorder affecting over 5 million people in the US. Many people with PCOS or endometriosis are also infertile. Almost all reproductive systems will go through menopause between the ages of 45 and 55, with 75% experiencing vasomotor symptoms such as hot flashes and night sweats.

Reproductive-related conditions can be costly to diagnose, require multiple rounds of treatment, and current treatment has significant side effects. The development of new treatments could significantly improve a variety of life-debilitating symptoms and quality of life. There’s also a huge economic benefit. A McKinsey report stated that advancing women’s equality can add $12 trillion to global growth, with reproductive health being a key driver3

The Current Market

There have been several companies in the last few decades that have been dedicated to advancing our understanding and treatments of reproductive disorders. Current drugs and drugs in development can be categorized into 4 main paradigms.

For more information on all drugs in clinical trials under women’s health, here is a comprehensive list.4 Any companies not included are listed here, additionally, if other companies should be added they can be listed here.

Top Selling Drugs & Performing Companies

In 2015-2016, the top five selling drugs in the market were targeted for post-menopausal women or contraceptives. Prolia was the top-selling drug, treating osteoporosis related to menopause. The remaining were mostly contraceptives, which are often prescribed off-label to treat various other reproductive health conditions such as Nexplanon.

In 2021, several sizable deals occurred in the space. One of the largest IPOs was Hims&Hers Health, a telehealth company that sells prescription and over-the-counter drugs online. Following Olema Oncology - a clinical-stage biopharma company developing therapies for female reproductive cancers. Progyny, an IVF insurance company, was the leading publically treading femtech company in 2021 and had a $130.0 million IPO (US). However, as of 2023, many of these companies are doing poorly and are at risk of being delisted.

It’s important to note that biotech IPOs are not always a sign that a drug has been approved/in the market. Mithra Pharmaceuticals had an IPO in 2015, with only their estetrol-based product candidates just entering clinical Phase III trials and Phase II trials.

As of 2023, a handful of private therapeutics companies have successfully raised Series A+ rounds. Celmatix raised $60 million to date, and its data set is now the largest database in reproductive health in the world. Gameto and Conception have both raised highly successful Series A rounds. Endoceutics recently raised about $85M, with some assets in development with Bayer.

The last few decades of pharma acquisitions in the space show that companies are primarily acquired by Merck Bayer, and Allergan, with the most common indications being post-menopausal. In 2018, AbbVie introduced the first pill for uterine fibroids and the first new drug for endometriosis in more than a decade and it brought in $145 million for AbbVie. In the last 5 years, Amgen, Eli Lilly, and Roche continue to manufacture drugs mainly for osteoporosis in menopausal women.

The biggest acquisition to date was KaNDy Therapeutics, a U.K biotech, by Bayer committing $875 million. Bayer quickly became a world leader in women’s health after a takeover of Schering Healthcare in 2006, inheriting hormonal oral contraceptives and an intrauterine device; however, as of 2023, Bayer announced that women’s health is no longer part of their core programs after receiving results less than what was expected in their pipelines. ObsEva’s later-stage assets all had less than promising results in 2022, later filing for bankruptcy and being delisted in early 2023. Organon also seems to be doing poorly, with shares dipping 12.5%.

The Rise of New Paradigms

In the past, hormone replacement drugs have done poorly. As with most drugs, oftentimes the pros outweigh the cons, however, it’s been well documented that the use of hormone therapy long-term can increase various risks with each year of treatment.5

Prempro by Pfizer, made headlines after the company paid close to one billion dollars in 2012 to settle lawsuits filed by women who were diagnosed with breast cancer after taking the drug. Nexplanon, a hormonal birth control patch manufactured by Organon, is also facing lawsuits with claims that the patch is linked to an increase blood clots and heart attacks.

However, there’s been an influx of companies taking a new approach. The ovarian aging paradigm is promising in that it shifts the way we look at these conditions from a single point in a woman’s life to a lifespan approach. Many of these companies are developing novel, alternative pathways to treating reproductive conditions. There’s also a handful of companies looking at leveraging the microbiome as a therapeutic. With the development of various at-home microbiome testing companies (such as Evvy), this is one avenue that could be promising, such as Luca Biologics.

Doing More in Reproductive Health

Several challenges and barriers can impact the development of safer and better treatment options. In vitro models to study the origins of various reproductive conditions have been poor, funding for basic research in academic labs is low, and historically there have been several hurdles around women’s participation in clinical trials for new drugs.

In the last decade, the total number of drugs approved for reproductive health lags behind other conditions6. In academic research, the number of research articles published on non-reproductive organs is 4.5x more than research on reproductive organs7. Most published research between 2011 and 2012 ignored the sex of the cells being studied.

Academic funding is heavily gender-biased. There is 5x more research on erectile dysfunction, a condition that affects 19% of men, than on premenstrual syndrome, a condition that affects 90% of women. In 2020, only 10.7% of basic scientific research funding went to women’s health topics, including pregnancy and fertility, and only 1% of biopharma R&D investment was in female-specific conditions excluding oncology8.

Clinical Trials

Running clinical trials can be a barrier in later-stage drug development. Most early-stage clinical trials are usually heavily comprised of male participants. Even when women are included in clinical trials, drugs are typically administered in the first phase of a woman’s menstrual cycle to limit the variables caused by fluctuating hormones.

In the US, women were not allowed in clinical trials until 1993 because researchers “viewed women as confounding and more expensive test subjects because of their fluctuating hormone levels”. Despite the mandates, low recruitment of women in trials is still a problem in early-phase trials, with women accounting for 29-34%. Since the FDA did not require both sexes in development, sponsors view trials with women as “financial and legal risks associated with a participant potentially becoming pregnant”.

Trials are also harder to design without specific measurable endpoints, so often it’s difficult to claim if there is a direct correlation between an infertility intervention and successful full-term pregnancy. However, similar to the longevity field, there may be alternate endpoints to assess a drug.

A New Approach

We need to a definition change. We need to approach reproductive health with a broader perspective on its impact on the overall health of women, and an entire population.

The reproductive system is a key command center, with an incredible ability to give rise to complex organs such as the placenta, remodel the human body for pregnancy, and grow an embryo - a complex foreign entity with its own immune system and bloodstream - without killing it.

Understanding the functions and molecular mechanisms of the system can help us understand a range of conditions beyond just female reproductive health. It can be a key aid in developing novel therapies for many other chronic conditions and cancers.

In the past, breast and prostate cancer research funding has increased significantly due to public campaigns and leveraging existing cancer research networks. Learning from this, reproductive health conditions could also gain research momentum.

For example, increasing research output can be approached by looking to advance new immunotherapies through understanding the placental immune system. It’s been shown that there are uterine natural killer cells (uNKs) that can be found only in the placenta. These cells could be explored for their potential use cases in the treatment of other diseases. Additionally, in pregnancy, it’s known that the heart remodels itself to compensate for the growth of the fetus and can reverse it back to its original state. Understanding the natural mechanisms of the repair of a heart can lead to a better understanding of cardiovascular disease in general. The uterus can also be used as a model to understand GCPRs better.

Final Thesis

In the last few decades, there have been many key leaders in reproductive health looking to help bring the field up, but many larger and older companies are struggling to stay afloat. Organon’s R&D head said it best:

“We're just part of the ecosystem. One company can't do it by itself”.

It’s important to note that this has just been the first generation of companies that targeted reproductive health. It gives us room to learn and grow, aiming to do even better and push the momentum even further.

We may have a bit of catching up to do in the therapeutics arena, but I believe the next generation of companies can become champion companies that can pull the field up after years of setbacks and failures. Biotech is notoriously difficult across any disease space and is known to fail, a lot. But the more people we have trying in this space, the more we can learn from failures and push forward.

We need more companies building research models to discover and test new drugs, develop more biobanks for research, and have diverse drug discovery pipelines that are focused on all aspects of reproductive health. We need to push for more cross-collaboration in different fields of academic and industry research to increase research and funding output, and emphasize the broader impacts reproductive research has on a generation.

With that, a few unanswered questions remain:

Will the next generation of therapeutic companies in the space be built by academics, big pharma, or hustling entrepreneurs?

Can we push the most successful diagnostic and telehealth companies to publish more open-source databases, and increase the participation of women in clinical trials?

How will ethics, regulatory bodies, data security, and policy play out? Will they be shaped as the science comes, or is there a need for more concrete guidelines put in place?

https://www.mckinsey.com/industries/healthcare/our-insights/the-dawn-of-the-femtech-revolution

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3443692/

https://www.mckinsey.com/featured-insights/employment-and-growth/how-advancing-womens-equality-can-add-12-trillion-to-global-growth

https://phrma.org/en/resource-center/Topics/Medicines-in-Development/Medicines-in-Development-for-Womens-Health-2022-Drug-List

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8034540/

https://pubs.acs.org/doi/full/10.1021/acs.jmedchem.0c01516

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9771341/

https://www.mckinsey.com/industries/healthcare/our-insights/unlocking-opportunities-in-womens-healthcare